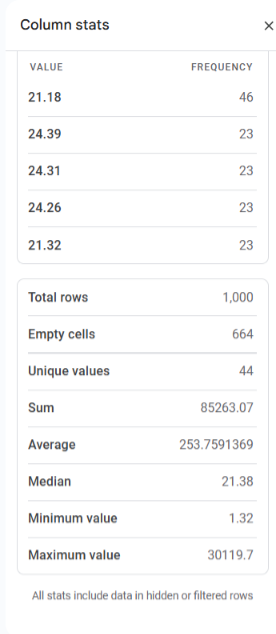

The fundamental unfairness in the I2G trial lay in the fact that all the “loss data” required to prove “victim losses” were false. Data belonged to a separate company, XTG1, and 28 million dollars in commissions earned were “filtered” from actual gains of “victim investors.” There was no reliable data linking victims to their “actual loss” or “gain.” Every single emperor purchaser gain/loss representation was false. Per a basic study of commission records 7240, every represented loss was inflated.

The Court read the indictment to the jury, referring to certain individuals as “victim investors” and describing their financial transactions as “securities.” These references were based on a list of initials representing “non-testifying” witnesses outside the statute of limitations. The labels “victim investors” and “securities” were also included in the instructions provided to the jury. The Court explicitly instructed the jury that these individuals were “victim investors” with “securities” losses. (doc 671 #7497)

“For Count 13, the third element that the Government must

prove that a member of the conspiracy committed an overt act

for the purpose of advancing or helping the conspiracy to commit

securities fraud with respect to the following securities. And

here in the instruction, as you can see, are listed all of the

victims, the dates in the second column, and the amounts shown

in the third column.“

So the Court directly, by oral and written instruction, told the jury these were “victim investors” and their product purchases were “securities.” The defense had no opportunity to cross-examine these non-witnesses on a list. However, the loss representations were all untrue.

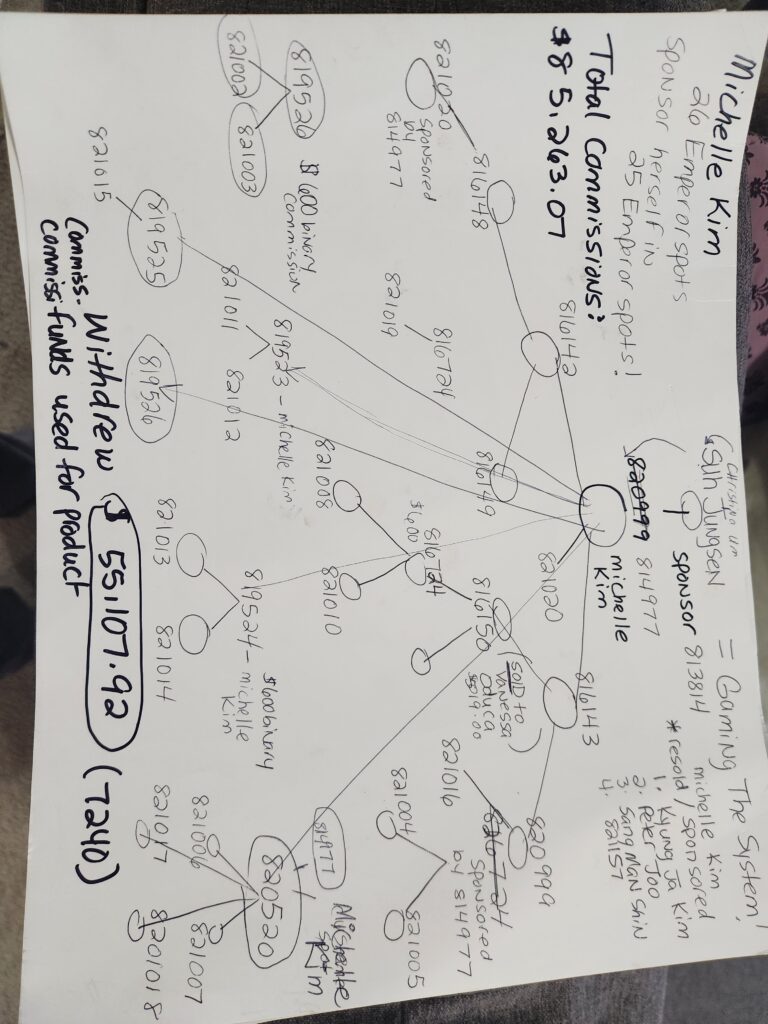

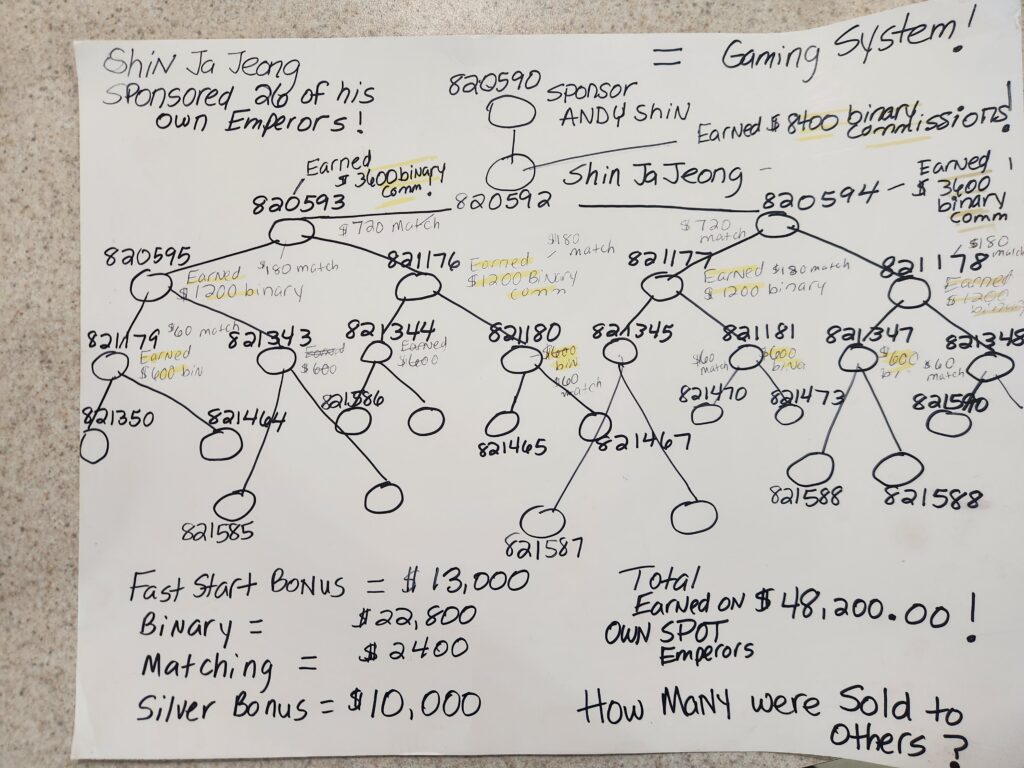

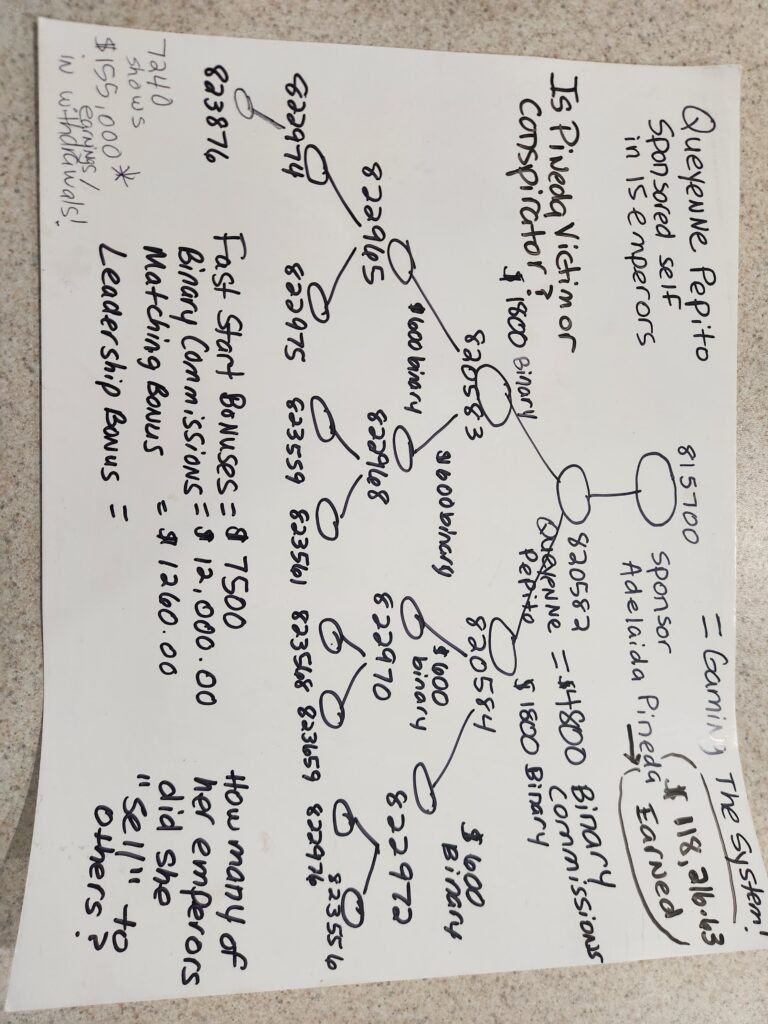

Agent McClelland misused his official position by misrepresenting “product purchases” made by non-witness distributors as “securities losses” experienced by “victim investors,” while failing to report their corresponding “gains.” He relied on hearsay and personal opinions to suggest reasons for these purchases. Additionally, he used three names to imply that significant losses had actually occurred. During the closing arguments, the government emphasized the “gross purchases” figures related to Michelle Kim, Shin Ja Jeong, and Queyenne Pepito to suggest that substantial losses had taken place.

However, these representations were false. The named individuals were part of Asian teams training distributors to “game the system.” They structured their purchases to maximize their earnings in the generous Infinity Two Global compensation plan, which included significant leadership bonuses and “resell” the packages to others. Their practices unfairly impacted all distributors, causing the company to “cap out” each week. The defense had no opportunity to confront these non-witnesses on these practices. They were simply portrayed as “victims.” The prejudice is explicit. Individuals who earned significant commissions were portrayed as “victim investors” by an FBI agent, the government, and the Court.

The sophisticated sponsorship structures of Kim, Pepito, and Jeongand their unreported earnings confirmed in government exhibit 7240 are attached. The totals of Michelle Kim’s earnings from 7240 reflect $85,263.07

An explanatory video is included.

None of these individuals was known to Hosseinipour at the time, and none appeared at trial, yet their suggested “losses” weighed heavily on the jury. The sophisticated “self-sponsor” strategies are apparent from the data, the government discovery, testimony at trial, and the Syn affidavit. Critically, the government has had the actual earnings data since 2017.