The government compiled a list of eight individuals, identified only by their initials, and labeled them as “victim investors.” This list was presented to the grand jury to support an indictment based on the “gross product purchases” made by these multi-level marketing (MLM) distributors. Among the individuals on this list, three accounted for most of the alleged victim purchases that facilitated the indictment: Michell Kim, Shin Ja Jeong, and Queyenne Pepito. During the trial, they were depicted as significant losers based on their “gross purchases” on the “victim investor” list, which did not account for their substantial commission earnings.

The list was read to the jury and introduced through hearsay from Agent McClelland. The alleged losses were emphasized again in the government’s closing arguments. Ultimately, the list labeled as “victim investors” and their purchases categorized as “securities” were presented to the jury along with jury instructions.

Notably, all the purchases were deemed to be outside the statute of limitations. The government contested one purchase as falling within the statute of limitations, despite enrollment three months beyond the deadline and the distributor’s repayment for the purchase occurring one month outside the limit.

However, the truth is that Pepito, Kim, and Jeong were far from victims. They were all substantial earners, actively promoting the business, collecting money from others, and earning considerable commissions. All three were allegedly involved in a Ponzi scheme called Better Living. Despite their significance in the case, none were called to testify; yet, their “alleged losses” were used as key evidence during the trial. It seems clear why they did not testify.

The gross purchase amounts of the MLM distributors were labeled as “victim investors,” which implied that their purchases were “losses,” and labeled as “securities purchases” on the list provided with the jury instructions. Notably, these gross purchases implied as “losses” did not account for the substantial commissions paid to “victim investors”. These commissions were used as a key funding source for purchases. The 7240 data shows significant and frequent internal funds transfers to and from distributors, formed into “gift certificates” to pay for their upstart packages.

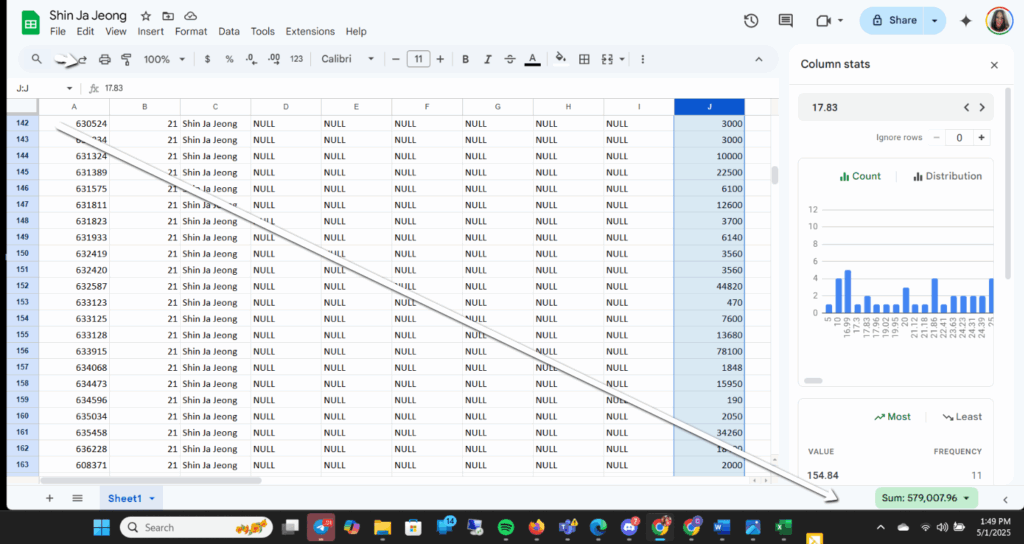

For example, Shin Ja Jeong received $570,000 in commissions, as shown in the spreadsheets that detail 240 internal transfers. These transfers allowed her to access funds from other distributors to pay her directly or vice versa. Much of this money was converted into “gift certificates” to purchase for oneself or to reimburse sponsors who pre-paid for the upstart packages. Since Jeong did not testify, this information was not presented to the jury.

Reynolds testified that these commissions were formed into “gift certificates” to pay for the product. The government was very aware of this, as they ordered the defendants’ “gift certificate” purchase records. They knew that excluding these commissions from 101i would filter out tens of millions of paid commissions.

Agent McClelland presented hearsay and improper opinions by suggesting that the substantial purchases of “emperor packages” could only be viewed as “investments.” However, distributors associated with Syn and Yu employed an “upfront” purchasing strategy to secure significant leadership bonuses through “shared” volume from multiple enrollments. The defense had the right to question the alleged victim-investors regarding the questionable business practices of “self-sponsoring” or “stacking,” as supported by the data. The hearsay and opinion testimony presented were inappropriate, and the data contradicts McClelland’s statements. However, once a statement is made, it cannot be taken back, which is why hearsay is not permitted—especially from a case agent whose testimony holds considerable weight.

McClelland was allowed to present excessive hearsay and improper opinions regarding distributor motivations in general. Notably, his hearsay included testimony indicating distributors were not interested in the multi-level marketing (MLM) aspect of I2G, undermining the pyramid scheme argument altogether.

After the trial, the government submitted an affidavit from Syn confirming that his team preferred to operate in cash. Data showing a significant number of internal fund transfers to and from “alleged victims” to pay for their packages further supports Syn’s affidavit.

This “loss” representation of the listed “victim investors” was presented to the jury before trial testimony began and included in the written jury instructions. To make matters worse, just before the jury began deliberations, the judge directly referred to the distributors on the list as “victim investors”. The judge also confirmed that a “securities purchase” had occurred within the statute of limitations when the jury raised a question, leaving the jury with no choice but to follow the court’s direction, ultimately leading to a conviction.

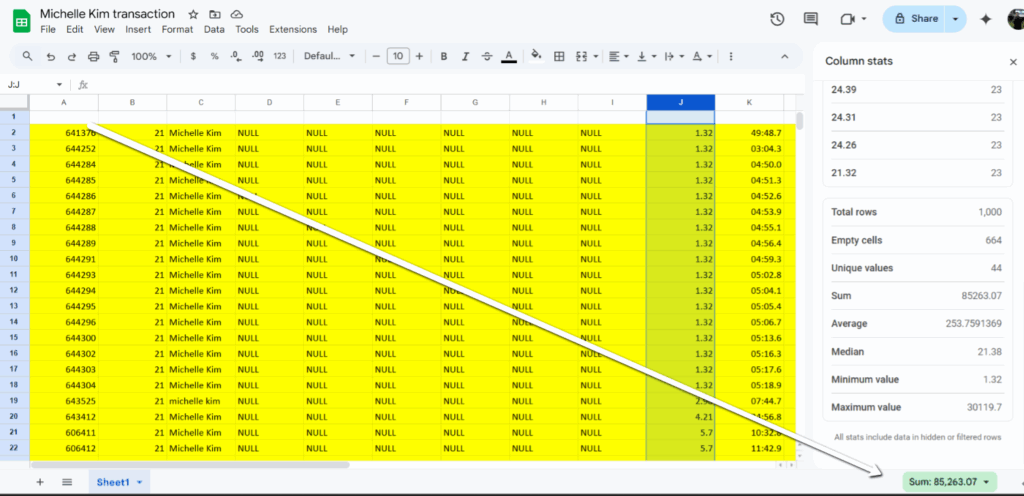

A fair trial was impossible based on hearsay and assumptions about non-witnesses, which the defense could not challenge. Critical information about the commissions received by these promoters was withheld from the jury. The prosecution falsely claimed that their data provider witness, Reynolds, stated the key commission data (7240) had “problems” and was unreliable, prompting them to obtain all new data, referred to as 101i, which excluded these commissions and transactions. This new data filtered out over $28 million in commissions from distributors, which had been converted into “gift certificates” used for these purchases. Jeong and Pepito, who did not testify, earned six-figure commissions withheld from the jury. Kim earned over $85,000. Shin Ja Jeon received over 579k, including many internal transfers from distributors she recruited who sent money directly to her i2g account.

During closing arguments, the prosecution highlighted significant purchases from the top earners Michelle Kim and Shin Ja Jeong, portrayed as losses. Since these individuals did not testify, the defense could not confront them on their substantial commissions or previous involvement in the Ponzi scheme, Better Living. Additionally, FBI Agent McClelland introduced improper hearsay regarding the losses of the many victim investors he allegedly spoke with, which the defendants could not challenge. This was particularly damaging as the actual trial witnesses reported small losses, conceded a complete understanding of the mlm nature of the business. They acknowledged signing terms and conditions, which made no promises and clarified that it was not an investment.

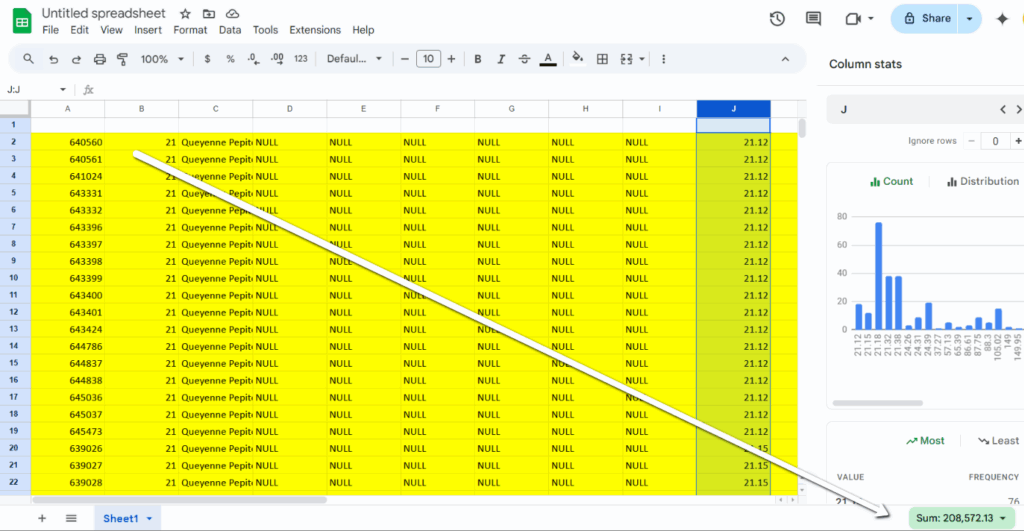

According to the judge’s impression, Queyenne Pepito was portrayed as “a poor lady who got suckered out of a ton of money.” The fact that this was his impression shows the government’s duplicity. According to data from 7240, Pepito earned over $208,000 in commission, of which $150,000 was withdrawn. The government included $170,000 in the restitution amount related to Pepito without verifying her earnings through bank accounts.

Shin Ja Jeong was portrayed as a victim who lost tens of thousands of dollars as an investor. However, data from government commissions indicated that she was actually one of the top earners in I2G, having received a total of $579,000 in commissions and qualifying as one of the earners of the $10,000 silver bonus. Additionally, she was a leading recruiter who collected significant amounts of money from individuals. The numerous high-value internal transfers to Shin Ja Jeong suggest that she was encouraging others to purchase multiple emperor packages at once. Because she did not provide testimony, the defendants were unable to question her about these practices.

It is noteworthy that the government claimed in bench conferences that anyone promoting I2g to others was an unindicted co-conspirator, yet they represented Shin Ja Jeong as a victim. They did not verify her bank accounts or commission transactions before labeling her as a victim investor and categorizing her substantial purchases as “securities” losses.

For More False Data in Summary Charts and Improper Investigative Hearsay from McClelland

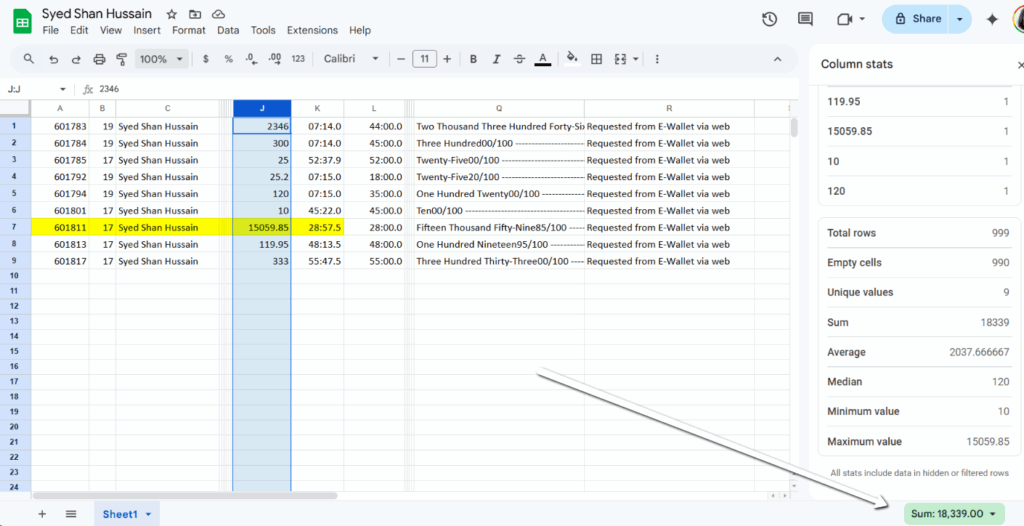

I added the commission records for Syed Shan Hussain. Syed was presented as a “victim investor” by the government, despite being a non-witness. The claims about his alleged involvement were crucial since an overt act by a conspirator within the statute of limitations determined whether the conspiracy charge for securities fraud could be dismissed due to the statute of limitations. https://defendmlmfreedom.com/no-overt-act-occurred-within-the-statute-of-limitations/

Hussain did not testify, but he was included on a “victim list” shown to the jury, where he was labeled as a “victim investor,” and his purchase was categorized as a “securities purchase.” However, the attached commission records reveal that he made nine commission withdrawals totaling over $18,000, indicating that he was not a “victim investor” as suggested by the government’s hearsay on their list.

The Sixth Amendment’s Confrontation Clause guarantees criminal defendants the right to confront witnesses against them, which includes the right to cross-examine those witnesses. This right is crucial for ensuring the accuracy of the truth-determining process in a trial, allowing the defense to test the credibility and reliability of the prosecution’s witnesses.

The reason why the Constitution has provided a confrontation right for all defendants to confront their accusers is clear. Without such protections, the government has offered unverified hearsay as factual evidence to convict defendants, as occurred in the i2G case unfairly.

You can upload the Excel document of Pepito’s earnings. Simply upload it into Google Docs and sort by column J. Pull up the column stats. You can similarly upload Michelle Kim’s and Shin Ja Jeong’s earnings.

https://docs.google.com/spreadsheets/d/1qPIGx5fJx5vb5Op1Y1pr9xqpMLTsers4EGTtTXUP8KA/edit?usp=sharing

Michelle Kim was a promoter and also earned $85,000 in commissions despite the government’s labelling her as a victim investor who lost tens of thousands of dollars. Since she did not testify the defense could not rebut these misleading depictions based on gross purchase amounts which were repeated in closing arguments.

The improper hearsay suggested that thousands of distributors like Queyenne Pepito, Michelle Kim and Shin Ja Jeong lost tens of thousands of dollars. However, the depictions of these non-witnesses are provably false per the data..

I have copied the “victim investor” list from the first superseding indictment. It indicates that Queyenne Pepita, Michelle Kim, and Shin Ja Jeong account for nearly all the purchases. Since they are labeled as “victim investors,” these purchases are implied to represent losses.

The indictment claims that defendants Maike, Barnes, Anzalone, Hosseinipour, Devorin, or Syn committed some overt act that caused these purchases; however, no evidence was presented at trial to support this. Notably, the key purchasers mentioned did not testify. Hosseinipour did not sponsor any of the alleged victims, and neither Pepita, Jeong, nor Kim interacted with Faraday or viewed any of her hangout videos.

Furthermore, none of the witnesses at trial stated that they spoke with Hosseinipour or credited her for their decision to participate. Instead, they attributed their choices to their sponsors, who were not charged. The grossly misrepresented losses among these distributors raise concerns about the government’s misconduct and knowing intent to defraud a court.

21 . In furtherance of the conspiracy and to achieve the object thereof, the Defendants,

RICHARD G. MAIKE, DOYCE L. BARNES, RICHARD J. ANZALONE, FARADAY

HOSSEINIPOUR, DENNIS DVORIN, and JASON L. SYN, committed and caused to be

committed the following overt acts by causing to be delivered by mail and by commercial

interstate carrier according to the direction thereon cashier’s checks for the purchase of Infinity 2

Global or 12G Emperor memberships on the dates and in the amounts set forth below:

Victim-Investor Date Amount

K.H. 06/21/2013 $5,000

K.H. 06/24/2013 $5,000

J.A. 06/17/2013 $1 ,020

J.A. 07/22/2013 $4,000

Q.P. 01/16/2014 $5,019.50

Q.P. 01/16/2014 $5,019.50

Q.P. 01/16/2014 $5,019.50

Q.P. 01/16/2014 $5019.50

Q.P. 01/23/2014 $5,019.95

Q.P. 01/23/2014 $5,019.95

Case 4:17-cr-00012-JHM-CHL Document 96 Filed 07/11/18 Page 6 of 19 PageID #: 573

Q.P. 01/23/2014 $5,019.95

Q.P. 01/23/2014 $5,019.95

Q.P. 01/23/2014 $5,019.95

B.F. 02/1 2/2014 $5,000.00

S.V. 02/07/2014 $5,000.00

B.W. 05/31/2014 $5,019.95

B.W. 07/27/2014 $5,019.95

M.K. 12/06/2013 $20,079.80

M.K. 12/10/2013 $100,399.00

S.J. 12/13/2013 $5,019.95

S.J. 12/13/2013 $5,019.95

S.J. 12/13/2013 $5,019.95

S.J. 12/13/2013 $5,019.95

S.J. 12/26/2013 $5,019.95

S.J. 12/26/2013 $5,019.95

S.J. 12/26/2013 $5,019.95

S.J. 12/26/2013 $5,019.95

S.J. 12/26/2013 $5,019.95

S.J. 12/27/2013 $5,019.95

S.J. 12/27/2013 $5,019.95

S.J. 12/27/2013 $5,019.95