The acts of prosecutorial misconduct include:

- There were direct and repeated lies presented to the court regarding statements allegedly made by their witness, Reynolds. These lies aimed to discredit exonerating data 7240, which documented $38 million in paid commissions to i2G distributors. This data contradicts all of their loss representations outlined in Spreadsheet 101i and Summary Charts 232 by an outstanding $28 million.

- Fraud upon the court due to knowingly presenting false data in all critical spreadsheets and a knowingly false 97% loss rate based on manipulated, filtered data.

- Manipulating Evidence – Filtering out $28 million in commissions paid to alleged victims to significantly inflate the loss representations used as the primary evidence in the trial. The $28 million in commissions that were excluded from the data included payments known to be the source of the alleged victims’ funds, referred to as “gift certificates.”

- They presented misleading information in Exhibits 101i, 101j, and 101d to misrepresent the total I2G gains and losses, as well as the gains and losses of 16 trial witnesses and several non-witnesses, where hearsay concerning those losses was crucial to their arguments. Additionally, they distorted the total I2G sales figures, levels, and product packages. This included two years of non-I2G data from XTG1, which operated only after I2G had closed.

- Suborning perjury involved knowingly providing “filtered” or fabricated data that inflated losses by at least 28 million dollars. This data was presented as Total i2G Gains/Loss spreadsheets, which four key witnesses testified were reliable. Additionally, this information was used with 12 distributor witnesses to present their inflated losses of approximately $ 15,000 according to 101i.

- Knowingly Presenting 2 years of data AFTER I2G was closed belonging to a separate company Xtg1- as I2G Data through 101b, 101a, 101G, 101G1, 101i, 101d, 101f

- Failure to correct known false statements of 4 key witnesses on known false Gain/Loss representation regarding 101i, 101F, 101j summary charts exhibit 230 232, and other data misrepresentations.

- Brady, Giglio, and Jenks’ violations by failing to disclose the contents of Richard and Susan Anzalone’s computers, which contained emails that were both exculpatory to the defendants and impeachment material against Anzalone

- Misrepresentation of the law, using personal opinion, and facts not in evidence in the closing argument

These misconduct allegations are definitively supported by data evidence, an affidavit from the data provider, testimony from government witnesses, government discovery, and trial testimony, which substantiate each allegation.

This complaint involves Western Kentucky Assistant District Attorney Madison Sewell, based in the Bowling Green Office in Western Kentucky.

Since this case is data-driven, every claim can be definitively proven through the data, which is reliable and accurate. By examining just three independent pieces of data that the government subpoenaed seven years before the trial, you can quickly verify the commissions paid to i2g distributors. This verification disproves their drastically inflated representations of total gains and losses made during the trial, showing that they knowingly manipulated the data to exclude these verifiable gains.

Given that this case heavily relied on data and aimed to present “losses” above the typical range of 85% to 87.5% found in multi-level marketing companies, the actions taken to manufacture inflated losses and invent victims must be recognized as serious misconduct rather than mere oversight.

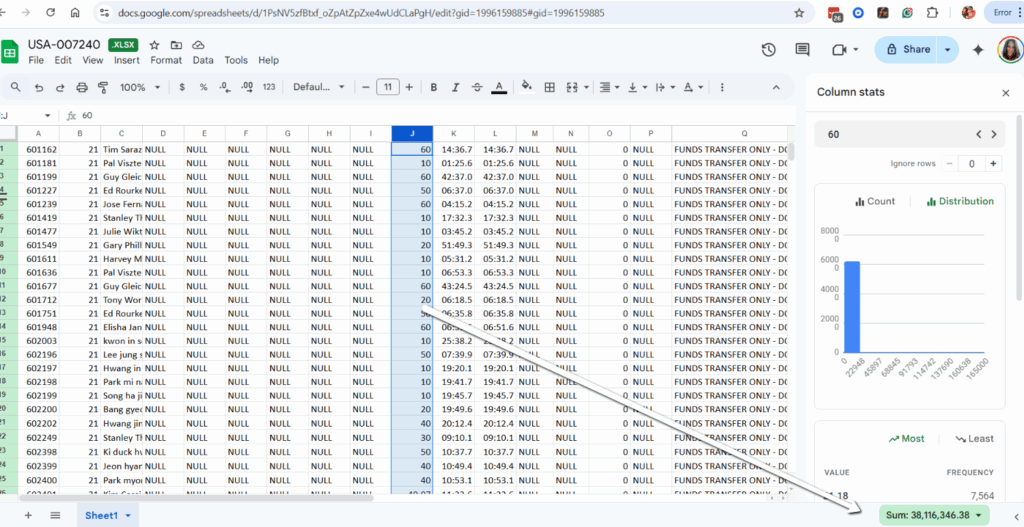

USA 7240 was subpoenaed seven years before the trial and lists every commission payment and transaction. To calculate the total commissions paid out, simply sort the data in Google Sheets by the column J field. The total amount of commissions earned is $38,116,346.38.

This total includes two components: (1) commissions requested for withdrawals to the e-wallet, and (2) funds transferred, which represent commissions that have been converted into “gift certificates” and used for product purchases or transferred to other distributors for their start-up purchases. The total transactions reflect all earned and “used” commissions.

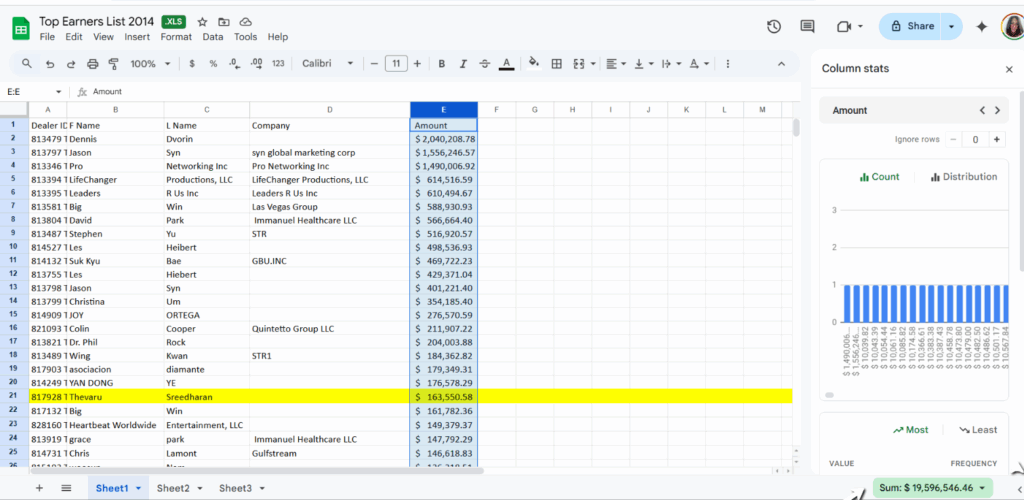

The government also had the i2G Top Earners List for 2014. This document reveals $20 million in paid commissions to the top 256 distributors, who collectively earned over $10,000 each in paid commissions. This spreadsheet comes directly from Jerry Reynolds’ records.

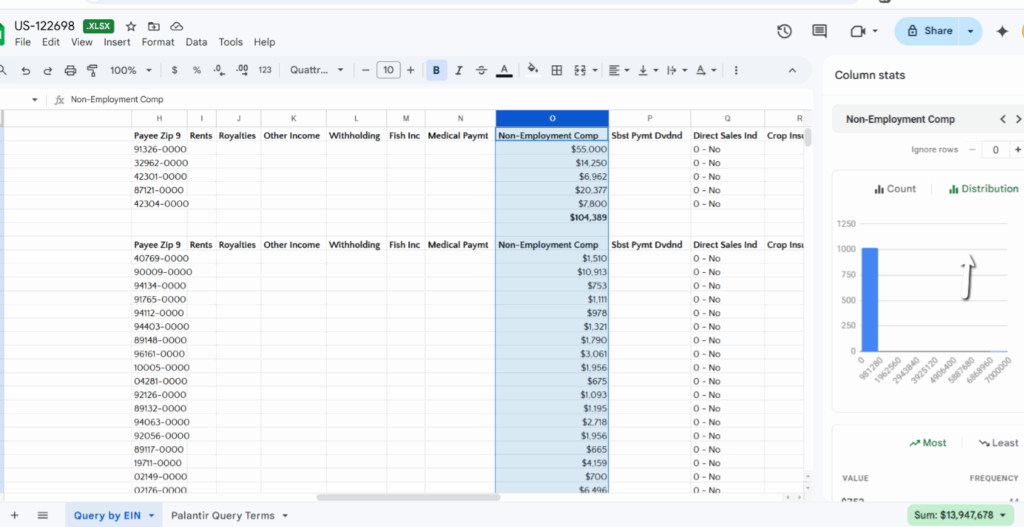

The government has US$ Exhibit #122,698, which is the 2014 I2G 1099 tax records. These were directly created from Jerry Reynolds’ system based on the commissions paid out in 2014. These show 14 million in paid commissions, with 600 people earning over $600

The commission numbers in 7240 contain an additional 18 million than the top earners list because they include the commission that was transferred into gift certificates to purchase distributor packages.

Notably, all of these commission findings are significantly higher than the representation the government presented at trial with 101i, which showed only $ 9 million in total payouts, with only $ 7.5 million in withdrawals from gpg, which was misrepresented as “Total Gains.”

Madison Sewell quickly prepared document 101i one week before the trial by excluding all “funds transfer” commissions that served as the source of the distributor’s product payments. He omitted all fund transfers to others related to the same start-up packages. Additionally, he filtered out millions of dollars in fast start and leadership bonuses, as well as all “pool cash” payments received each month by every emperor purchaser. This filtering accounted for nearly 80% of the total earned commissions.

The government requested that Reynolds only include the commissions that were withdrawn from GPG, resulting in a significantly reduced representation of total commission gains and an inflated representation of losses in 101i. The government failed to inform the Court or the defense that it had filtered out over $28 million in paid commissions and that numerous other issues existed with 101i, resulting in additional millions of dollars in inflated losses.

Sewell misled the Court by claiming that Reynolds reported that 7240 “had problems” and that the data was inaccurate. However, after the trial, Reynolds produced an affidavit confirming that 7240 was correct and that the government had filtered out significant commissions. The government escalated its fraudulent actions by suborning perjury through the provision of false data to their witnesses, misrepresenting it as accurate. They instructed four key witnesses to testify that the manipulated figure for total gains and losses represented the actual totals for i2g distributors. This misleading information was the basis for expert Keep’s analysis, which assigned a demonstrably false 97% loss rate to i2g. Furthermore, two FBI agents presented the “filtered” data as accurate representations of total gains and losses. Additionally, the data provider misrepresented the figures as the total i2g gains and losses.

Numerous misrepresentations concerning 101i significantly inflated the reported losses by millions of dollars. This included known “gifted” packages, $800,000 in waived autoship payments, and $600,000 in refunds. These “credits” were inaccurately classified as “losses” for 101i, alongside millions of dollars in unresolved credit card fraud cases, unpaid corporate positions, and 2,650 “customer” packages, which were also misrepresented as losses. Even after FBI Agent Sauber acknowledged these inconsistencies, Sewell failed to inform the Court about the seriousness of these misrepresentations and falsely asserted that there would be minimal impact on the loss findings.

The overwhelming evidence of government fraud is derived from their discovery materials, witness testimonies, admissions made during appeals, and statements from FBI Agents McClelland and Sauber. Additionally, Jerry Reynolds, along with Agents McClelland and Sauber and William Keep, made admissions during the trial that validated Sewell’s awareness of his misrepresentation. A formal affidavit from their witness and data provider, Jerry Reynolds, confirms that false statements were made to the Court and the defense regarding his alleged claim that the exonerating data (7240) had “problems” and was unreliable.

In McClelland’s testimony, he stated that Reynolds’ records indicated that $40 million had been paid in commissions to distributors. He provided an example showing that Reynolds’ records indicated Jason Syn earned $3 million; however, he could not trace the source of that money in his bank account. This suggests that McClelland may not have fully understood or taken the time to learn how the i2G compensation system worked.

Despite this, he had subpoenaed the defendants’ “gift certificate” purchase records, indicating that he, along with Sewell, possessed substantial knowledge about the situation. If he had engaged with Reynolds to understand how commission payments were utilized by distributors to cover their purchases or to assist new distributors with their start-up costs, he would have quickly realized that the claimed 97% loss rate was incorrect, as reflected in his summary charts.

If he did engage with Reynolds but chose to misrepresent losses or conceal these significant “gains” on his summary charts by a margin of 80%, he would have committed a deliberate fraud on the Court, which should be regarded as a criminal act.

Madison Sewell engaged with Reynold on at least three occasions. He was fully aware of the purchases of “gift certificates” since he questioned Reynold about them while on the stand. Additionally, he had subpoenaed the purchase records for the “gift certificates” related to the defendants. Sewell was also knowledgeable about “gifted” packages, waived auto-ship services, and $600,000 in refunds. He obtained testimony regarding these items from his witnesses and included them in his summary charts.

FBI Agent Sauber, who succeeded Agent McClelland, presented the same false evidence regarding Total I2G’s gains and losses in 101i. He acknowledged all the circumstances of false evidence that accounted for millions of dollars in inflated losses during the Maike sentencing under questioning by Kenyon Meyer.

Sewell misrepresented summary charts 230 and 232, which were presented by Agent McClelland based on deceptive actions, specifically filtering out the majority of paid commissions used as the “source” of payments. All four key witnesses referred to these summary charts, assuming they accurately represented the data. However, a total of $28 million in commissions was excluded, representing only 20% of the total commissions, specifically those withdrawn from GPG. Instead, McClelland categorized the gross purchases made with “earned commissions” as “losses.” Consequently, the summary charts showed inflated losses and nearly nonexistent gains. These results were contradicted by multiple pieces of data available to Sewell, including Document 7240, the i2G top earners list, the 2014 i2G 1099 records, and the lists of silver and gold bonus earners.

The newly issued 101i presents a misleading account of all gains and losses associated with All I2G by excluding $28 million in paid commissions to the alleged victims. Additionally, it fails to account for millions of dollars from transactions that did not happen, such as $800,000 in waived auto-ship fees, $600,000 in refunds, and millions more in “gifted packages.” This manipulation of data resulted in a misrepresentation of losses that was as much as $32 million higher than what was shown to the jury. In summary, Sewell provided loss figures for victims that were inaccurate, lacking a truthful representation of actual purchaser losses in 101i.

The misleading loss data was presented as “loss evidence” during the questioning of 16 witnesses, and it also included false losses attributed to multiple individuals who were not witnesses. Presenting 101i as an accurate representation of i2G Gains and Losses was a deliberate act of subornation of perjury involving four key witnesses—two FBI agents, one government expert, and the data provider. Each key witness made false statements regarding the representations of Total i2G Gains and Loss in 101i and other data. Sewell failed to correct any of these inaccuracies, as required by the Napue decision.

The inaccuracies in the government spreadsheets significantly affected the entire trial, as nearly every witness relied on this flawed data, including nine government distributor witnesses and two defense distributor witnesses. This erroneous information was also utilized to create misleading representations of “hearsay” losses among non-witnesses, which were included in the jury instructions. The distributors were labeled as “victim-investors,” and their total purchase amounts were inaccurately referred to as “securities purchases,” implying that these represented losses. This representation was misleading because the commissions earned by these distributors were not deducted from the purchase amounts. In reality, some of the non-witness “victim-investors” had substantial earnings in i2G. Non-witness hearsay regarding these “false losses” was frequently cited in both the opening and closing statements. Similar to the 101i case, the claimed victim losses are demonstrably false, as evidenced by the 7240 data and 1099 records.

Furthermore, two years of data from a separate company, XtG1, were included in all seven of the government’s spreadsheets, despite XtG1 only commencing operations after i2G was closed. As a result, every statistic derived from this data was proven to be false. There were over 4,000 distributor entries for XtG1 and $4 million in XtG1 sales incorrectly attributed to i2G.

All relevant documents, testimonies, and data supporting these allegations can be emailed or are already published on www.defendmlmfreedom. Jerry Reynolds can be interviewed and can pull new data that supports these findings. Verifying the inaccurate data is straightforward as this is what the data supports. Reynolds submitted an affidavit stating that the 101i data used during the trial was “filtered.”

The government portrayed I2G as a pyramid scheme with a 96% loss rate; however, the data tells a different story, indicating significantly higher-than-average earnings for a multi-level marketing company in its first 18 months of operation. Government Exhibit 7240 and the “Total Commissions” data gathered by Reynolds after the trial indicate that more than $38 million was paid out in distributor commissions.

The government substantially exaggerated the losses associated with I2G, as represented in their Total Gains and Losses report. This misleading information harmed the testimonies of 16 witnesses. Many, many other misrepresentations represent misconduct, but these are the most serious.

You can view the total commissions paid to i2G distributors through three sources attached below

1.) Exhibit 7240

2.) I2G Top Earners list,

3.) i2G 1099 records

The 7240 report indicates that over $38 million was paid in commissions, which includes commissions used as a source for product payments. The Top Earners list reveals that nearly $20 million was distributed to 256 distributors in 2014 alone. Furthermore, the 1099 records show that $14 million was paid to i2G distributors in the same year. All of this data was sourced from Jerry Reynolds’ system. These three sources illustrate significantly higher commission levels than the $7 million presented to the jury in 101. Moreover, the extensive data demonstrating higher commissions and fewer i2G “victims,” below the statistical average for a typical MLM, was in the government’s possession seven years before the trial.